When most people think of waterfalls, the first thing that comes to mind is likely Niagara or Victoria. Waterfalls in the legal sense are not nearly as breathtaking or awe-inspiring as these natural curtains of water. Nonetheless, when properly drafted, a distribution waterfall in an operating agreement is a fairly impressive provision.

Meaning and uses of waterfalls:Distribution waterfalls are generally used in situations in which a client wishes to form an LLC, elect partnership taxation, and provide for varied (i.e., non-pro rata) economics among the members.

Whereas distributions from an S corporation must be based strictly on percentage ownership, distributions from an LLC can be based on a more complicated priority-based formula (i.e., a distribution waterfall). For example, certain members may receive the value of their contributed capital, plus a preferred return, before any other members receive distributions.

Preferential economic rights are the cornerstone of distribution waterfalls. The provision is referred to as a “waterfall” because it sets out, from top to bottom, the order of priorities for distributions among the members. LLCs with different classes of interests use waterfall provisions to specify how distributions are made between the classes.

Business Docx makes drafting any type of business entity a breeze.

Distributing LLC interests:

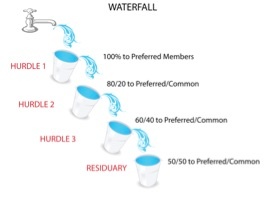

In the following illustration, the LLC has two classes of membership interests: preferred interests and common interests. This waterfall provides that 100% of an LLC’s distributions must be given to the preferred members until Hurdle 1 is achieved. The parties can define hurdles to match their agreement. Commonly, the initial hurdle will provide the preferred members with a 10% return on their capital contributions.

After that hurdle is achieved, the distribution will be given 80% to the preferred members and 20% to the common members until the next hurdle is achieved. Suppose Hurdle 2 is reached when the preferred members have been returned their capital contributions.

Then, moving down to the next tier of distributions, any additional distributions would be given 60% to the preferred members and 40% to the common members until the preferred members have received $50,000 in the aggregate (i.e., Hurdle 3). Once that hurdle has been achieved, all remaining distributions (the residuary) will be split 50/50 between the preferred and common members.

While planning distribution waterfalls might be intimidating, gaining an understanding of their mechanics can enable business attorneys to draft sophisticated provisions to achieve their clients’ desired economic arrangements.

The Business Docx® operating agreement includes such sophisticated drafting options as a distribution waterfall. Learn how these WealthCounsel resources can help you in planning strategies in order to meet your clients' needs.