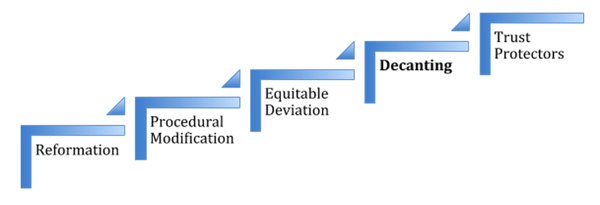

In Part I of this blog series on Trust Modification, I addressed the first three (the simplest) modification options: Reformation, Procedural Modification and Equitable Deviation. Let’s continue up the stair steps to Part II and the more complex option of decanting.

Decanting ranks fairly high on the spectrum of trust modification options and it’s the first level that affords real creativity and flexibility. It occurs when the trustee of an existing irrevocable trust (often referred to as the “originating” or “inception” trust) exercises his or her discretion in making distributions for the benefit of a beneficiary and, rather than distribute the property from the trust outright, the trustee distributes property in further trust (the “new” trust).

The origins of decanting stem from the position that if the trustee may distribute property outright – as 1L property class taught us, in “fee simple absolute” – to a beneficiary, then the trustee may distribute property in less than fee simple, by creating a new trust to manage the distributed property for the benefit of the beneficiary of the property. The trustee’s power to decant may arise from a state’s case law, from statute, or within the governing trust instrument. Currently there are 33 states with provisions for decanting. No state has an expressed prohibition.

Tax Questions Arising from Decanting. In the absence of clear IRS guidelines, the tax-related questions surrounding decanting are complex and uncertain. To apply our earlier golf analogy, it’s as if golf’s governing body says that a golfer may, under certain circumstances, take a preferred lie, but refused to describe the applicable circumstances, doesn’t define what preferred means, but will still penalize you if they later decide that you did not apply the rule correctly. For illustration purposes, here are a couple of common tax-related questions.

Does a beneficiary who consents – or acquiesces – to decanting make a taxable gift?

Perhaps. To provide the lawyer’s answer, sometimes it depends on the nature of the decanting. The safer approach – the approach many recommend – is to permit the trustee to exercise a decanting power without beneficiary involvement at all. This is especially true when acts of decanting alter the nature of beneficial rights or dispositive provisions, or modify powers of appointment.

Moreover, if the power to decant is indeed a power of the trustee, the trustee should be permitted to exercise that power subject to the trustee’s fiduciary obligations. A beneficiary should be required to show that the act of decanting constituted a breach of the trustee’s fiduciary duties in order to object to or set aside the decanting transfer.

Does an interested trustee who decants make a taxable gift?

When the trustee has no interest in the trust, we believe that the trustee who decants in furtherance of his or her fiduciary duties has no transfer tax concerns. Further, the Regs provide that even when the trustee does have an interest in the trust, if the trustee makes a transfer in furtherance of a fiduciary duty, and if that duty is limited by a fixed or ascertainable standard, then the trustee has not made a taxable transfer.

Where the act of decanting is intended to strengthen the asset protection character of the trust to convert from an ascertainable standard trust to a discretionary standard trust (and where this is permitted by governing law), it is more effective to have an independent trustee effect the decanting. Where a beneficiary or other interested party is serving as trustee, that interested trustee may resign to make way for an independent trustee to perform the decanting. In the alternative, a special independent trustee may be appointed concurrently with the trustee (either under the terms of the document, as provided by Wealth Docx, or by petition and appointment by a court) to then exercise the power to decant the trust to a more protective structure.

Many other questions about the tax implications of decanting remain, but unfortunately the IRS’s lips are, for now, sealed. Until that bright day when Treasury fully colors in the lines for us, we should counsel trustees carefully and err on the conservative side when decanting unfavorable trusts.

Important note: In September, as part of our Continuing Legal Education curriculum, Wealth Counsel will offer an in-depth, multi-day course on “Modification Options for Irrevocable Trusts.” Take advantage of this opportunity to update yourself on the law and the various trust modification options available.

Is trust decanting part of your practice? Please share your experiences, concerns, and best practices in our comments section.