America’s largest generation is about to become your most valuable estate planning demographic

Defining a Millennial

If you’re an employer, a parent, or both, then it will come as no surprise to you that Millennials are a little different than previous generations. Most don’t prioritize the same traditional values as your generation or those of their parents and grandparents. The stereotypical Millennial is tech savvy, entrepreneurial, and socially conscious. On the downside, many people associate Millennials with job hopping, instant gratification, and sometimes, poor work ethic.

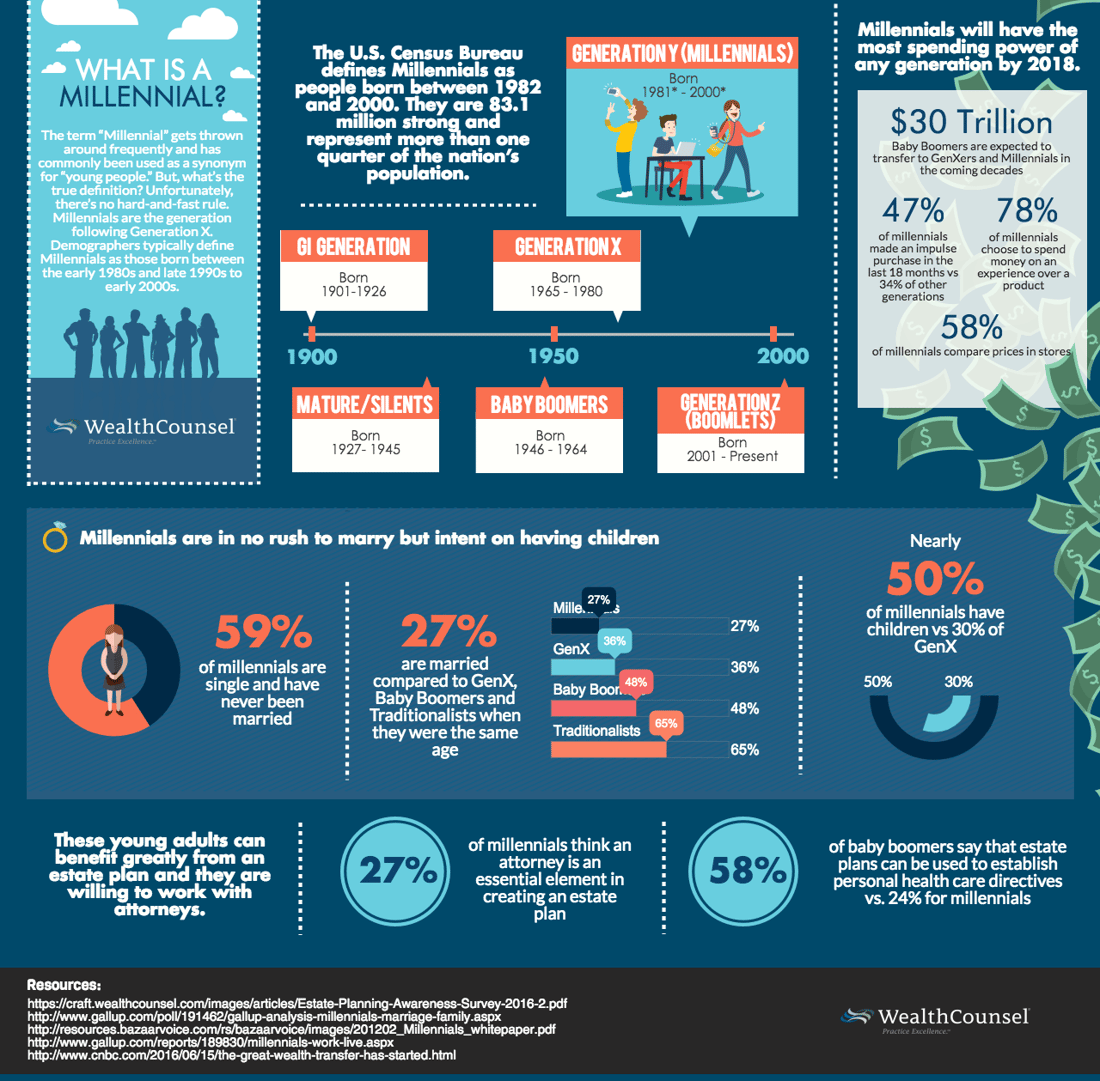

The reality is that while these twenty- and thirty-somethings value work-life balance and collaboration, many are also saddled with student-loan debt and are slower to marry, have children, and buy homes than previous generations. According to a 2014 Gallup poll, only 27% of Millennials were married compared to 36% of Gen Xers and 48% of Baby Boomers when they were the same age.

Millennials settle down later than previous generations, and they’re also waiting longer to consider estate planning. But despite the public perception, this generation is growing up fast, and for a large segment of it, the time to create a will or trust is now.

The key to capturing the Millennial market is speaking their language and conveying the value of an estate plan. This guide explains why the largely untapped Millennial market presents opportunity for estate planning attorneys and how to convey the value of estate plans to this unique generation.

Why Millennials are an Emerging Market

Before we get specific about Millennials, let’s be clear: you shouldn’t eliminate any demographic from your list of potential estate planning clients. Nearly every person has reason to consider estate plans. Proper estate planning can help people achieve many goals, including:

- Designating a guardian for children

- Ensuring homes are transferred to designated beneficiaries in the event of death

- Keeping a business in family hands throughout generations

- Protecting your family assets in the case of future divorces

- Avoiding probate

- Maintaining privacy of assets since trusts are not public records

- Making provisions for digital assets/online accounts

In particular, Millennials are a valuable market to tap into for estate planning attorneys. The demographic now represents more than a quarter of the U.S. population. In the coming decades baby boomers — the country’s wealthiest generation — are expected to transfer $30 trillion to Gen Xers and Millennials, according to CNBC. That means millions of young people will inherit significant wealth. These young adults can benefit greatly from an estate plan.

As an estate planning attorney, you should be ready to capture this demographic. Fortunately, it seems that this generation understands the value of attorneys in the estate planning process: 73% of Millennials think an attorney is an essential element in creating an estate plan.

How to Speak Their Language

Many Millennials adopt a “forever young” mentality and, for better or worse, rarely consider the prospect of death. That’s understandable for the young and healthy.

To connect with Millennials, it is important to explain why estate planning is beneficial and why even the young and healthy need to plan for the future.

Whether they believe it or not, Millennials will grow old. The days of bungee jumping and world travelling will inevitably come to an end, and it will be time to settle down. Until then, estate planning can help Millennials facilitate the preservation of wealth (in the event that trek to Machu Picchu goes awry), manage their assets (even a valuable record collection), and also provide peace of mind (about who will look after the cat). A comprehensive estate plan allows these clients to:

- Control property while they are alive

- Provide for themselves and loved ones if they become incapacitated

- Give what they have to whomever they want, the way they want, and when they want

- Minimize the impact of fees and taxes

The key message is that estate planning allows Millennials to decide how to bequeath any inheritance should something ever happen. Inheritance to Millennials may likely go beyond financial assets. Educating Millennial clients about the benefits of estate planning may require a shift in perspective and tactics to focus on items of importance beyond their current bank account like:

- Vehicles, including boats

- Jewelry, including vintage heirlooms

- Family memorabilia

- Pets

- Electronics

- Digital Assets

Millennials often get categorized as lazy, financially irresponsible social media junkies. Connecting with them in a way that shows estate planning helps them enjoy life, maintain freedom, and care for others is more impactful than judging them for making different life choices than previous generations. Wills, trusts, and powers of attorney can all help protect their assets and ultimately offer more freedom.

For example, a simple will can save a lot of potential anxiety for a relatively small investment for a Millennial wanting to embark on exotic travel adventures. Trusts provide more comprehensive protection, with the added benefit of privacy, for Millennials with complex assets or who may be considering starting their own technology business or nonprofit. Appointing a power of attorney might be a good option for Millennials living with a partner but not ready to sign a marriage license.

In addition to connecting estate planning with Millennial values, attorneys need to look at the preferred communication style of this market. Gone are the days of three hour, in-person meetings around a big conference table when working with Millennials. They are extremely mobile and prefer instant, ongoing communication rather than sitting down for a long involved conversation. Attorneys will lose the interest and patience of Millennial clients if in-person meetings are required for every estate planning decision. Email is a must for sending messages and files, but other modes of communication to consider are:

- Texting

- Video Conferencing (i.e. FaceTime)

- Instant messaging (i.e. WhatsApp, Facebook Messenger, Slack)

Marriage or the birth of a child is often the triggering event for preparing an estate plan. Millennials are taking longer to hit these milestones. The average 20- to 30-year olds may be less likely to address estate planning for the same reasons their parents did at this age. Attorneys need to keep this trend in mind when considering estate planning for Millennials. Although working with younger clients will be an increasing part of the estate planning business, attorneys need to be aware of triggers and communication styles that speak to the Millennial market. Attorneys must adapt and meet these clients on new terms.

America’s largest generation

Millennials are both America’s largest generation overall, and the largest generation in the U.S. labor force. In 2015, Millennials overtook Gen Xers as the largest generation in the workforce, and in 2016 surpassed Baby Boomers as America’s largest generation.

Protecting Digital Assets

More than any other generation, Millennials rely on the digital world for many of their day-to-day services. Whether it’s online banking, social media accounts, or personal files stored on the cloud, many Millennials’ assets are in digital form.

What happens to those assets upon death? It’s a question the industry is still catching up with, but your clients can name a digital executor to their estate. This (preferably tech-savvy) individual becomes responsible for managing the deceased’s digital assets and paying any outstanding debts on their digital accounts. Additional responsibilities could include:

- Transferring any income-generating digital assets to heirs

- Deleting files from computers or other devices and erasing hard drives

- Archiving personal photos, videos, music, and other files

- Maintaining or closing online accounts

- Transferring accounts to heirs

Much like a traditional executor, a digital executor can be named in your client’s will. Digital executors aren’t officially recognized by all states, but can still be named as a co-executor of a will with digital-specific responsibilities.

Marketing Estate Planning Services

Estate planning isn’t just for the wealthy or older, established generations. Spouses, parents, and homeowners of all ages all have reason to consider estate plans regardless of their net worth.

Estate planning attorneys need to think strategically about how Millennials communicate and connect to capture a portion of this valuable demographic. Here are a few tips to keep in mind when marketing your services to this unique group.

- Traditional tactics like phone book listings, networking with financial planners, and hosting dinner seminars will not work. Think social media instead of the phone book and webinars instead of dinner seminars.

- Technology is their preferred way of communicating and planning. Start to get comfortable corresponding via text, live video, and email.

- Conversations should be less about data and more about experiences. Millennials want open-ended discussions that tie actions to meaning and doing the right thing.

When thinking about marketing to Millennials, cater conversations around giving back and making a difference. Give them opportunities to connect beyond a face-to-face meeting or a phone call and position yourself as a friendly educator rather than an all-knowing attorney.