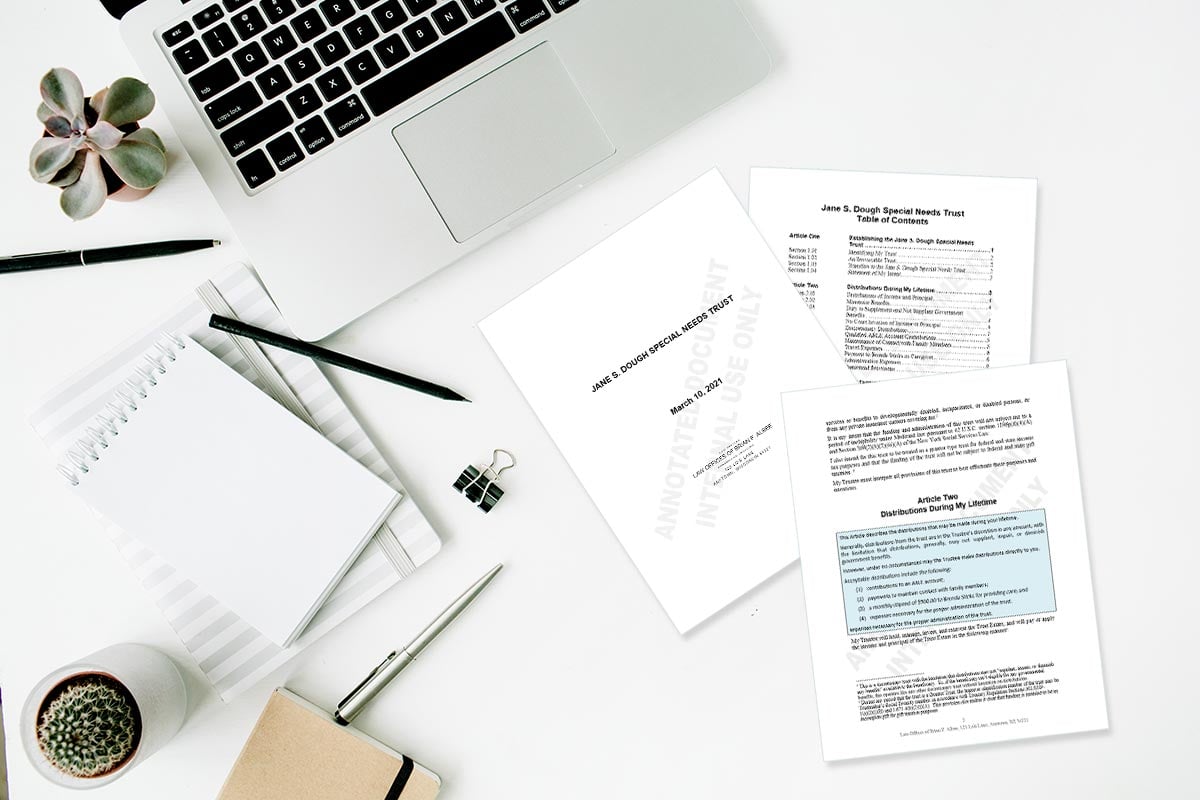

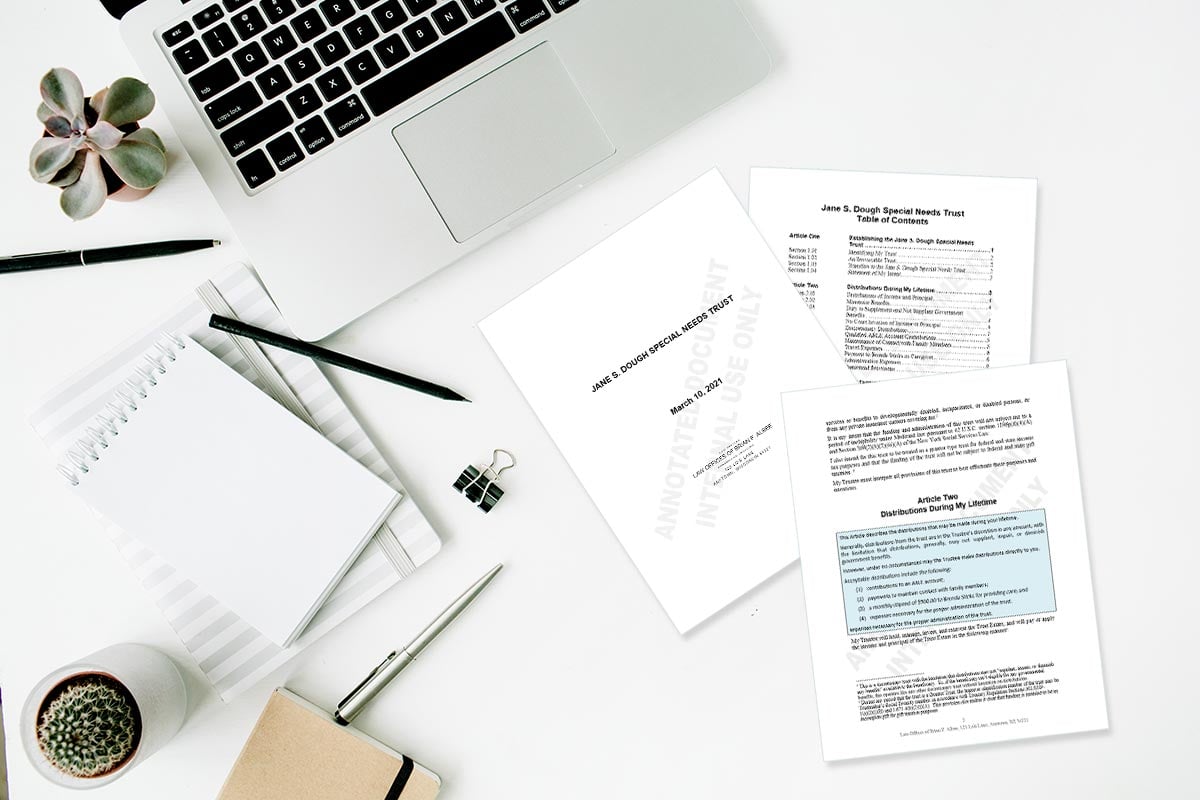

Elder Docx™ has always had the ability to draft a Self-Settled Special Needs Trust, but with our recent software update, you can now draft an annotated version!

The Self-Settled Special Needs Trust, often referred to as a d4A trust, is a first-party trust; meaning, the assets used to fund the trust belong to the beneficiary. This trust allows the beneficiary to have these funds set aside to pay for certain things that government benefits don’t provide for, while still allowing the beneficiary to maintain eligibility for public benefits.

Elder Docx also has an option to draft an annotated Self-Settled MSA trust. This trust is used when a Medicare Set-Aside subtrust is needed, which is often when the beneficiary is awarded a personal injury settlement or a Workers Compensation award. The amount of the award that should be set aside for future medical expenses related to the injury are funded into the MSA subtrust to be preserved for such use.