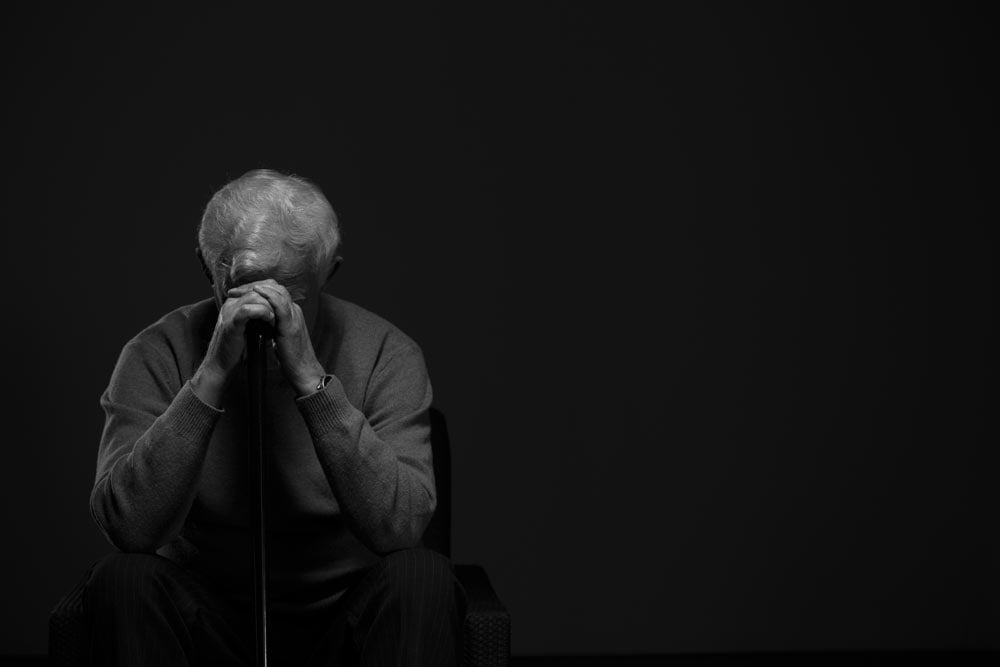

According to the National Council on Aging, 1 in 10 elders in the U.S. have experienced some form of abuse, yet only 1 in 14 is reported. It is a sad reality that there are elders in our communities that suffer from various forms of abuse. Financial, physical, and sexual abuse are common examples of the ways in which our older generation is exploited and endangered. Unfortunately, elder law attorneys are likely to encounter such a client at some point during the course of their careers.

Every lawyer is, or definitely should be, familiar with the Rules of Professional Conduct for the states in which they practice. A primary tenet of lawyering is the duty of an attorney to keep their client’s disclosures confidential. With that in mind, how does an attorney balance the need to keep client information confidential with a moral or legal requirement to disclose potential elder abuse?