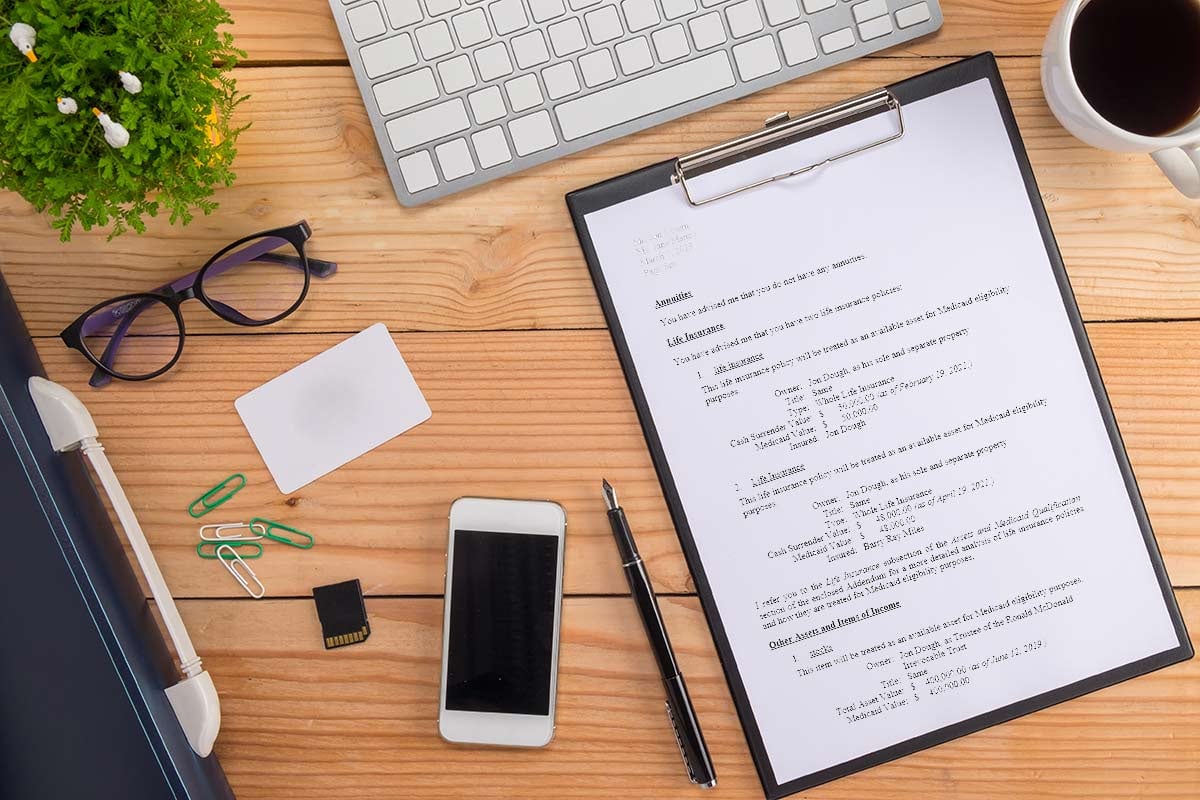

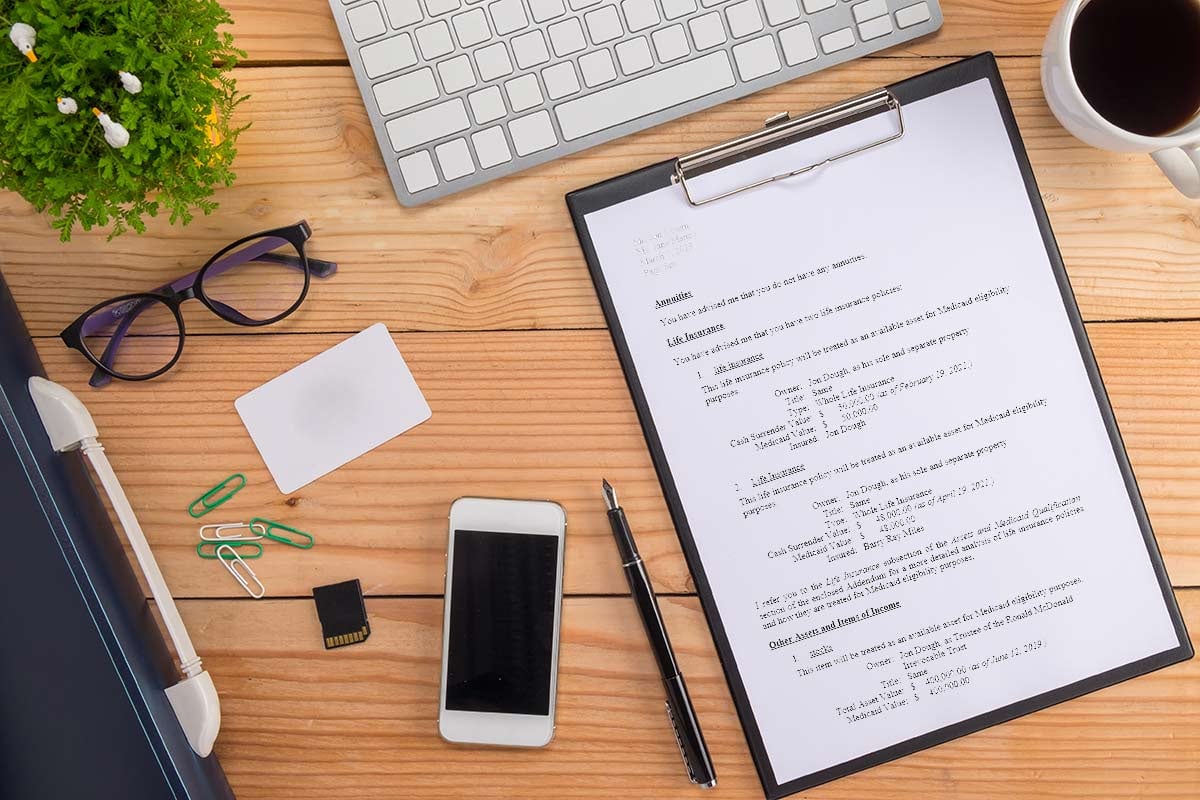

Elder Docx™ offers many amazing documents to draft, but today we are going to focus on the Medicaid Asset Protection Letter (MAPL). Let’s explore this long-term care planning document and its amazing capabilities.

The MAPL is a planning letter. You would use it after being hired to set out the roadmap for the client’s case in order to get the client qualified for Medicaid. The MAPL lists the client’s income and assets and then details strategies for dealing with excess income or assets. For example, if you are planning in an income cap state and the client has too much income, the letter may suggest using a Miller Trust. If a client has $100,000 in excess assets, then you can select the planning strategies to deal with the excess assets and get the client qualified for Medicaid. You may suggest using a Medicaid Asset Protection Trust, buying an exempt asset, or more. There are about 23 strategies that you can select from, or you can formulate your own strategy!