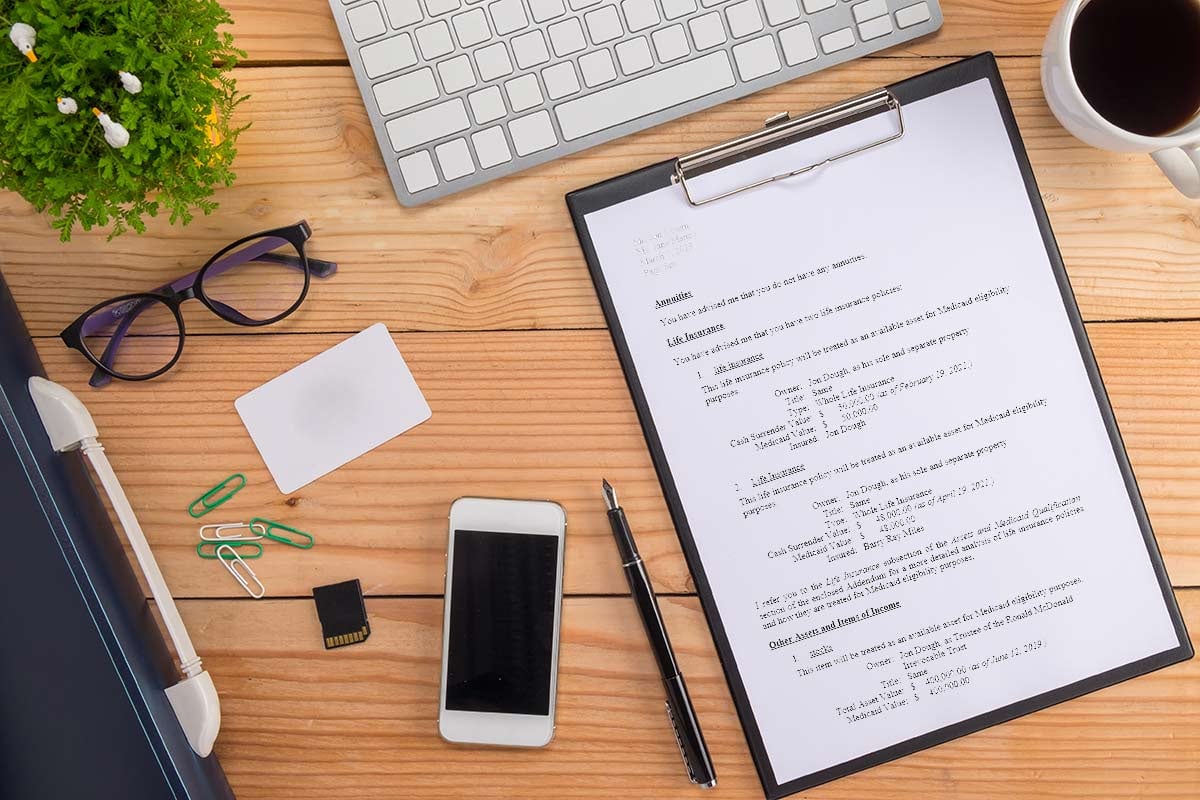

Elder Docx™ offers many amazing documents to draft, but today we are going to focus on the Medicaid Asset Protection Letter (MAPL). Let’s explore this long-term care planning document and its amazing capabilities.

The MAPL is a planning letter. You would use it after being hired to set out the roadmap for the client’s case in order to get the client qualified for Medicaid. The MAPL lists the client’s income and assets and then details strategies for dealing with excess income or assets. For example, if you are planning in an income cap state and the client has too much income, the letter may suggest using a Miller Trust. If a client has $100,000 in excess assets, then you can select the planning strategies to deal with the excess assets and get the client qualified for Medicaid. You may suggest using a Medicaid Asset Protection Trust, buying an exempt asset, or more. There are about 23 strategies that you can select from, or you can formulate your own strategy!

You would list any prior transfers in the MAPL, and could plan for any transfers that happened during the look-back period. You can also include information regarding long-term care insurance, debts that the client has, and other general information about Medicaid eligibility.

The MAPL can be used in a proactive planning case, where the client is planning in advance, or in a crisis planning case where the client needs to qualify for Medicaid soon. The MAPL can be used when the client is wanting to qualify for home care service benefits, long-term care (nursing home) benefits, or assisted living facility benefits.

Not only is the MAPL a blueprint of the case to keep everyone (both clients and staff!) on track, it serves as a cover-your-bases for the elder law attorney so that he or she has documentation that the client is aware of how the case should proceed. The client gets a clear picture of what is going to happen in their case, with the numbers and strategies to back it up. The attorney gets peace of mind knowing that everyone is on the same page. Win-win!

If the client is a Veteran, you may instead want to use the Veterans Asset Protection Letter (VAPL). This document can plan to get the client eligible for Veteran’s pension benefits. Or, if the client may be eligible for both Medicaid and Aid and Attendance benefits, you can structure the VAPL to address both!

What are some other documents you can draft with Elder Docx? There is a suite of special needs trusts (SNT), including a First-Party SNT, Third-Party SNT, Parental Protection Trust, Sole Benefit Trust, and Secure SNT. There are protection trusts, including the Medicaid Asset Protection Trust, and the Veterans Asset Protection Trust. Elder Docx can be used to draft a Standalone Will, Revocable Living Trust, Financial Powers of Attorney, Healthcare Powers of Attorney, and many other documents. Contact us today to see Elder Docx in action.

.png)