Estate planners have needs and concerns that change each year. That is why WealthCounsel teamed up with Trusts & Estates magazine and Informa Engage to conduct an annual survey of more than 500 estate planning professionals.

This year’s major topics included cryptocurrency and nonfungible tokens (NFTs); referral sources; and the upcoming sunset of the Tax Cuts and Jobs Act. Read on for details about the survey results.

Cryptocurrency and NFTs

Sixty percent of survey respondents reported that they have clients with cryptocurrency or NFTs in their estates. In addition, 64 percent of respondents have clients who have asked for advice on these digital assets. This is a strong indication that cryptocurrency is not a fad, but rather a viable part of the global financial landscape.

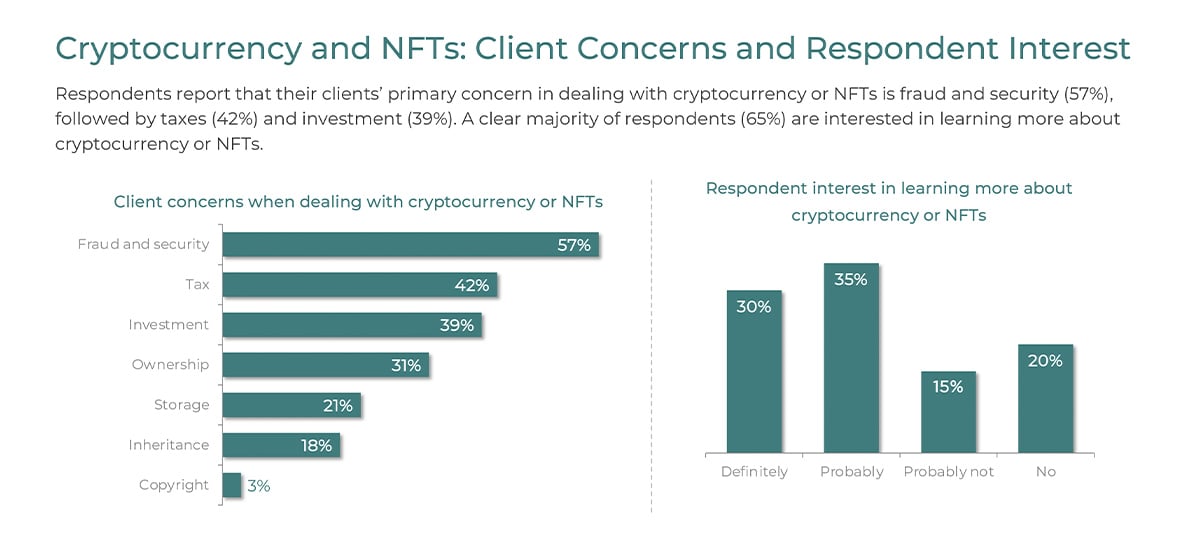

This topic is still like the Wild West in many ways, however, so clients rely on estate planners’ expertise. Respondents reported that their clients’ main concerns are fraud and security (57 percent of respondents), taxes (42 percent), and investment (39 percent). Other concerns include issues of ownership, storage, and inheritance.

The most important thing to know about cryptocurrency is that the Internal Revenue Service treats it like property, rather than currency. That means that clients who hold their coins for a long time could be subject to capital gains tax if their portfolio increases in value.

NFTs seem to be waning in popularity compared to their boom period in 2021. Active NFT trading plummeted from one million to half a million in the first half of 2022. One reason is concern about “hackers, thieves, and scammers.”

Another problem affecting the NFT market is an abundance of supply. The value of these digital assets is tied to how scarce and special they are, but there are five NFTs available on the market for every interested buyer. Buyers may have remorse over some of the purchases that took place during the height of the NFT boom. An NFT of the first tweet, which came from Twitter founder Jack Dorsey, sold for $2.9 million—but when it came time to resell it, nobody was willing to pay more than $14,000.

The cryptocurrency market seems to be weakening as well, as indicated by a sell-off of $870 million worth of digital coins in a twenty-four-hour span. The Luna currency, a stablecoin tied to the value of the US dollar, had to be rebooted after it became worthless, resulting in a $40 billion loss.

Despite these setbacks, the digital currency and NFT markets are not destined to go the way of pet rocks and Beanie Babies. Since many of your clients already own these assets, you should learn more about them to serve your clients’ needs.

Client Intentions

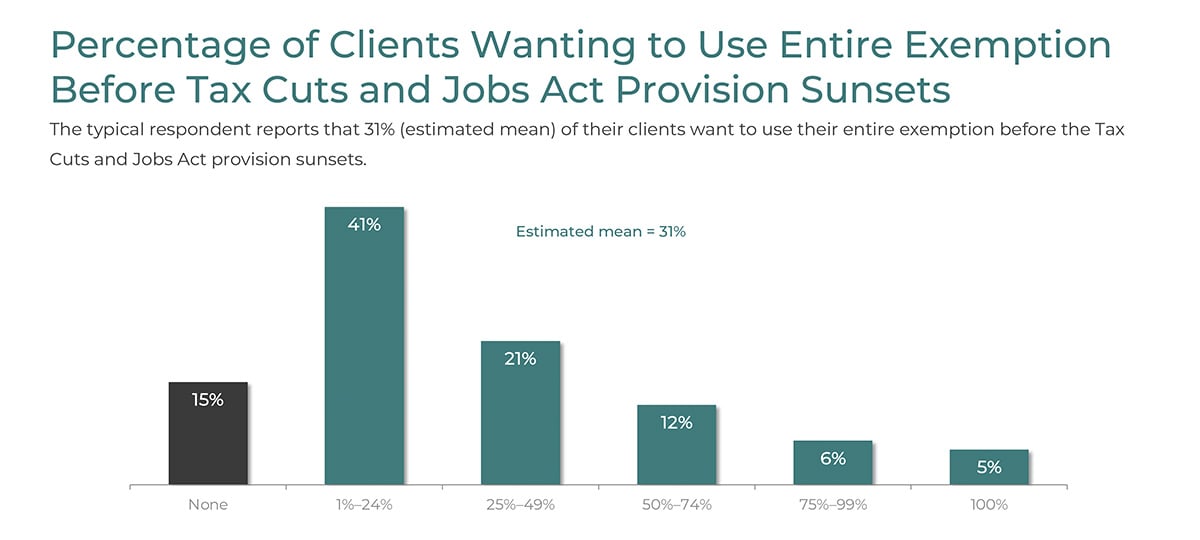

Looming on the calendar at the end of 2025 is the sunset of the doubled estate tax exemption that was part of the 2017 Tax Cuts and Jobs Act (TCJA). The current estate tax exemption of $12.06 million will be cut in half to its previous level of $5 million, adjusted for inflation. The survey showed that an estimated mean of 31 percent of clients want to use their entire exemption before the TCJA sunsets. A whopping 92 percent of respondents have at least some clients who want to make large lifetime gifts. This indicates the large wealth transfer that will take place from Baby Boomers to their heirs.

Having a strong grasp of the TCJA and its estate and gift tax provisions will allow your clients to make the most of the larger exemptions while the TCJA is in effect. Other aspects of the TCJA include income tax brackets increasing and deductions for charitable gifts decreasing.

Referral Sources

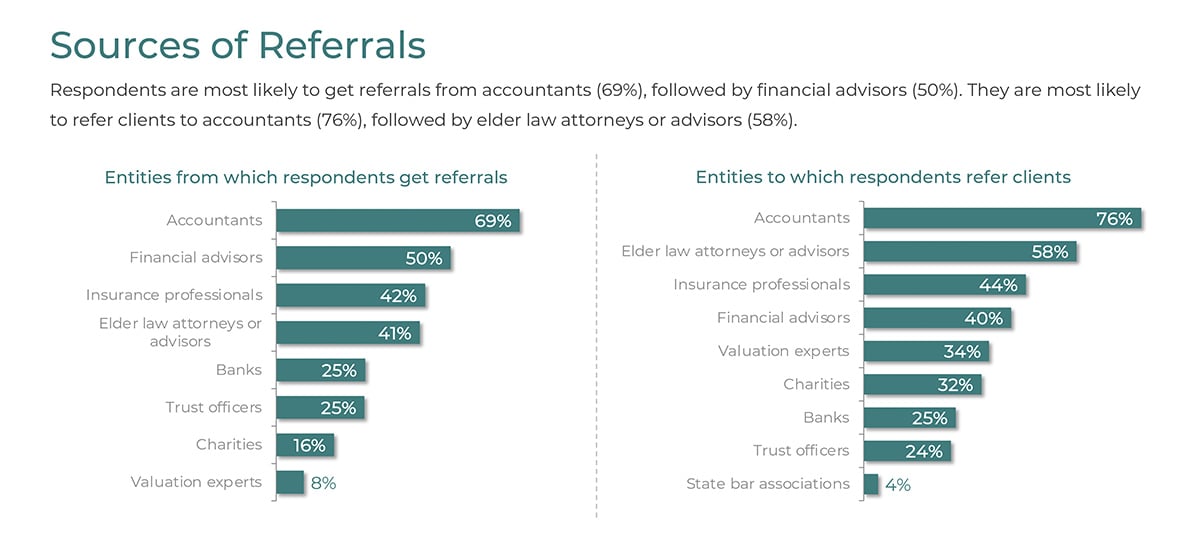

The most common referral source for estate planning attorneys in 2022 is accountants (69 percent), followed by financial advisors (50 percent), insurance professionals (42 percent), and elder law attorneys or advisors (41 percent).

Estate planning attorneys are most likely to refer clients to accountants (76 percent), followed by elder law attorneys or advisors (58 percent), insurance professionals (44 percent), financial advisors (40 percent), and valuation experts (34 percent). Other sources of ingoing and outgoing referral sources include banks, trust officers, and charities.

These statistics show that referral-based marketing continues to be a valuable method for generating new prospects. If you are not doing so, make sure to cultivate your relationships with these sources.

Staying On Top of Industry Trends

The 2022 Estate Planning Trends report covers several other topics, including no-contest clauses, quiet trusts, and the deceased spousal unused exclusion amount. Download the full report for free here.