Piercing the veil is an important concept for any business planning attorney to understand. Piercing the veil originated in the corporate context, but has been increasingly used by courts to hold members of limited liability company (LLCs) liable for the entity’s debts. What does it mean to pierce an entity’s veil, and what we can do to protect our clients from the risk of this occurring?

Veil piercing is a judicial remedy that is used in extraordinary circumstances to permit creditors of a corporation or an LLC to go after the business owners’ personal assets. In other words, business owners often choose to operate their business as a corporation or an LLC because of the asset protection these entities provide. In the case of both a corporation and an LLC, the general rule is that the owners will not be held liable for the business’s debts and obligations – a limited liability veil is said to protect them from the business’s creditors. But with every rule comes exceptions. And one of the exceptions to limited liability occurs when the limited liability veil is pierced by a court to hold the entity’s owners liable for the entity’s debt.

What types of circumstances typically lead to veil piercing?

There are several factors that courts look at in determining whether an entity’s veil should be pierced. These factors vary by state, as does the weight of any given factor in the analysis. Three common factors that are identified by courts in veil piercing analyses include situations in which an entity is:

- An “alter ego” of it's owners. In other words, the entity and it's owners are one and the same – there is a lack of separateness between them.

- Grossly undercapitalized. If an entity is formed but it is not infused with enough capital to cover it's costs, then it may be viewed as a mere shell entity which would be disregarded for asset protection purposes.

- Used to perpetuate fraud. In some jurisdictions, courts will not pierce the veil without this factor being present.

One final factor in veil piercing analyses that is somewhat controversial in the LLC context is the failure of owners to observe formalities. In the corporate context, there are numerous statutory formalities that must be adhered to, such as holding regular meetings, maintaining minutes, and making certain filings. Failing to do so puts the owners’ limited liability at risk. But in the LLC context, it is trickier. The Uniform Limited Liability Company Act, the Revised Uniform Limited Liability Company Act, and several state statutes expressly provide that the failure to observe an LLC’s company formalities is NOT grounds for piercing the veil. However, this factor has been identified by courts in LLC veil piercing cases as a factor in the analysis. It is controversial in the sense that business owners often choose to operate their businesses as an LLC, rather than a corporation, to avoid the stricter statutory requirements that exist for corporations. LLCs are flexible entities and owners have wide latitude to set the rules by which they will be managed and operated. Therefore, to hold owners liable for business debts when certain formalities are not maintained seems counter to the flexible nature of the entity.

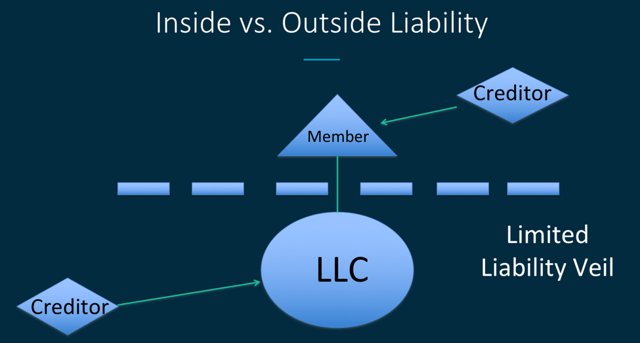

Here is a simple illustration of veil piercing that also helps to explain the concept of “inside” versus “outside” liabilities — vocabulary commonly associated with veil piercing:

If you view the dotted line as the limited liability veil, you can imagine that veil protecting the owner or member from the LLC’s debts. Inside liabilities are those inside the LLC. They are the result of obligations owed by the LLC to its creditors. Outside liabilities, by contrast, are those belonging to an LLC’s owners. They are the result of obligations owed by an owner to its personal creditors.

An LLC is generally protected from its owners’ personal debts by what is known as charging order protection. If an owner’s personal creditor is able to obtain a charging order, the LLC merely pays that creditor from distributions the debtor/owner would otherwise be entitled to. In other words, the creditor cannot loot the assets of the LLC to satisfy the judgment.

Client Counseling

As business planning attorneys, we are in a position to advise our clients on the risks of veil piercing and offer some best practices for maintaining the protection of the limited liability veil. Such advice may include:

- Encouraging clients to keep detailed business records.

- Ensuring that clients comply with the terms of an entity’s governing documents during the life of the entity.

- Reminding clients of the need to amend the terms of an entity’s governing documents if they no longer meet the needs of the entity or serve the intent of its owners.

- Emphasizing the importance of keeping adequate funds in the LLC’s operating account, allowing it to pay all debts as they come due.

- Reminding clients to acknowledge and prioritize ongoing LLC compliance responsibilities.