In my previous blog, Part II – Decanting, I addressed the option where a trustee exercises his or her discretion in making distributions for the benefit of a beneficiary and, rather than distribute the property from the trust outright, the trustee distributes property in further trust. This modification provides an alternative when the results intended by the original trust instrument cannot be successfully achieved as the trust is actually administered.

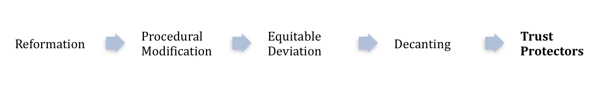

As a further safeguard to ensure a grantor’s intent is fully and faithfully executed, we now move to the top step in our ascending staircase of Trust Modification options: modification by Trust Protectors.

The Trust Protector is the most creative, most aggressive of the Irrevocable Trust Modification options. Its origins can be traced to the offshore asset protection realm where wealthy clients move assets offshore, establish a trust in a foreign jurisdiction with strong asset protection laws (e.g., the Cook Islands, Bermuda, Belize) so assets are more secure from the reach of creditors.

In recent history (the last decade or so), the Trust Protector has increased dramatically in popularity as a means to modify an irrevocable trust. Unlike its offshore counterpart, the appointment of a domestic Trust Protector is not only for asset protection but also for flexibility in planning. At its core, the Trust Protector’s role is to serve as a “watchperson” over the trust and ensure the grantor’s intent is accomplished. Like a golf caddy, the Trust Protector provides helpful oversight and assistance when needed, but is not actively involved in every shot.

A Trust Protector’s powers can be quite broad and include such steps as removing and replacing a trustee, moving the trust’s jurisdiction, changing distributions based on changes in the beneficiaries’ lives, resolving disputes between beneficiaries and trustee and vetoing transactions. As always, careful drafting of the trust document, with specificity in the enumeration and definition of powers, is key to establishing an effective Trust Protector.

One question that regularly arises: Is the Trust Protector a fiduciary? The lawyerly response: It depends. My advice is to look closely at the power being exercised. If the power is “trustee-like” (directing investments or distributions, approving accountings, etc.), I would argue that the Trust Protector is a fiduciary. On the other hand, if the power is “court-like” (such as moving the jurisdiction of the trust, or expanding or contracting beneficial interests and powers of appointment), I would maintain that the Trust Protector should not be subject to a fiduciary standard. Again, in the drafting stage, be specific as to when and under what circumstances the Trust Protector would be subject to fiduciary standard or non-fiduciary duties.

Important note: In September, as part of our Continuing Legal Education curriculum, Wealth Counsel will offer an in-depth, multi-day course on “Modification Options for Irrevocable Trusts.” Take advantage of this opportunity to update yourself on the law and the various trust modification options available.

Is the appointment of Trust Protectors part of your practice? Please share your experiences, concerns and best practices in our comments section.