As an estate planner, you should always be attuned to your clients’ goals, especially when estate and gift tax laws change. WealthCounsel conducted a survey with the help of Trusts & Estates magazine and Informa Engage of more than 500 estate planning professionals to gain insight into estate planning trends. The survey results revealed several popular goals for 2022, relating to large lifetime gifts, the upcoming sunset of the Tax Cuts and Jobs Act of 2017, and the deceased spousal unused exclusion (DSUE) amount. Read on to learn about clients’ estate planning goals.

Use the Full Estate Tax Exemption Amount

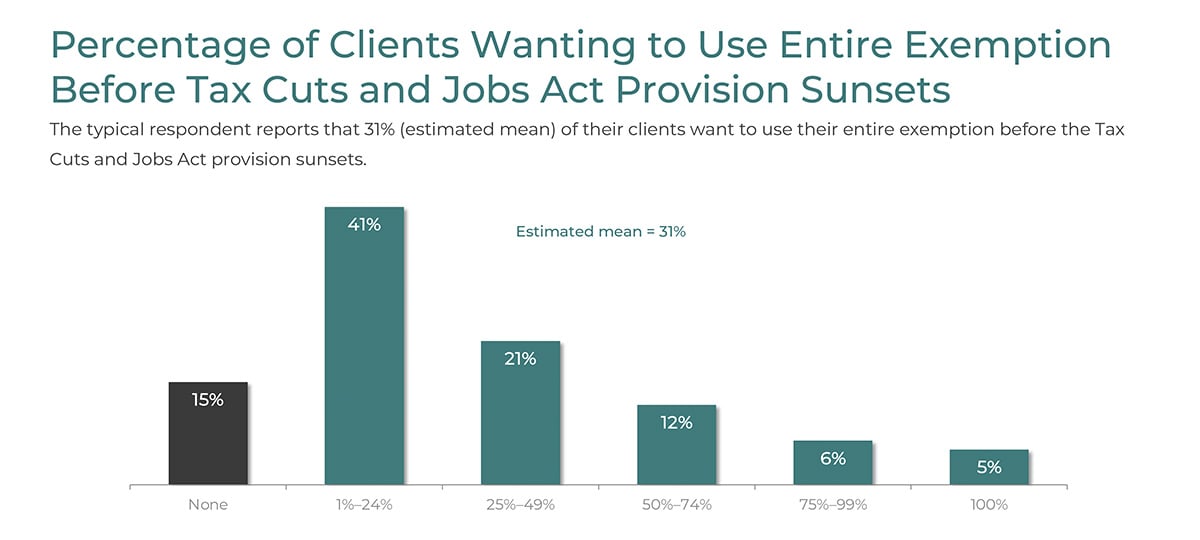

Certain provisions of the Tax Cuts and Jobs Act of 2017 (TCJA) will sunset at the end of 2025. Notably, the estate tax exemption amount, which is currently $12.06 million, will revert to the previous amount of $5 million adjusted for inflation. This amount will likely end up over the $6 million mark. Survey respondents reported that an estimated 31 percent of their clients intend to use the entire exemption amount before it disappears.

Other provisions of the TCJA that will be expiring at the end of 2025 without congressional intervention include the following:

- Mortgage interest limited to $750,000 per married couple

- Standard deduction increased to $25,900 per married couple

- Child tax credit doubled to $2,000

- Upper limits to claim a child tax credit increased from $75,000 to $200,000 for single parents and from $110,000 to $400,000 for married parents

The top estate tax rate is 40 percent, which applies to amounts over $1 million. Estate planning attorneys well-versed in estate and gift tax rules can employ strategies to minimize the value of clients’ estates subject to estate taxes at death.

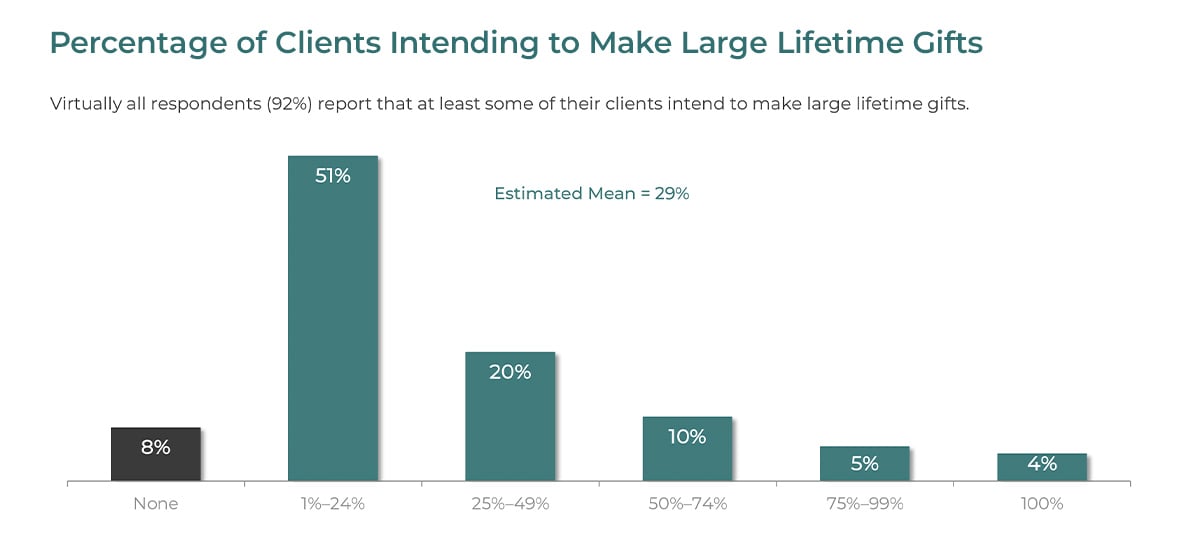

Make Large Lifetime Gifts

The wealth transfer from baby boomers to their heirs is in effect, as 92 percent of survey respondents say they have clients who are interested in making large lifetime gifts. This ties into the urgency of using the $12.06 million basic exclusion amount before it decreases. Be mindful that this amount is per individual, so a married couple has a combined $24.12 million exemption amount until the end of 2025.

Another number to keep in mind is the annual gift tax exclusion amount of $16,000. A client can give a gift of $16,000 to an unlimited number of recipients without incurring gift tax. However, a gift of $20,000, for example, would reduce the lifetime exemption amount by the additional $4,000.

The following gifts are not taxable:

- Gifts to a US citizen spouse

- Gifts to a charity that has been approved by the Internal Revenue Service (IRS)

- Gifts paid directly for someone’s school tuition

- Gifts to a political organization

- Gifts paid directly to cover someone’s medical expenses

A Word About Clawbacks

Some clients may wonder if the government will apply the lesser exemption amounts after the TCJA sunset if the estate holder makes large gifts during their lifetime while the exemption amount is high, but then dies after 2025. Fortunately, the IRS has issued an anti-clawback clarification. In November 2019, the IRS issued regulations stating that it would not “claw back” taxes on a large lifetime gift made after the exemption amount is reduced. That means that if you make a gift while the exemption amount is $12 million, you will not have to pay tax on the amount that is in excess of the exemption amount applicable at the time of your death, even if the exemption available at your death is less than the total amount of gifts made during your life prior to 2026.

In April 2022, the IRS issued proposed regulations clarifying the 2019 anti-clawback regulations. Under the proposed regulations, gifts to trusts that allow the grantor continued access to the gift will not receive the benefit of the anti-clawback regulations, including gifts to the following types of trusts:

- Grantor retained annuity trust

- Grantor retained income trust (artwork)

- Qualified personal residence trust

However, gifts to other types of trusts that might allow the grantor continued access are still subject to anti-clawback protection, including the following types of trusts:

- Special needs trusts

- Charitable remainder trusts

- Marital trusts

- Credit shelter trusts

- Irrevocable life insurance trusts

- Spousal lifetime access trusts (most of them)

The reason for the newly proposed clawback regulations is that the IRS wants to make it more attractive to give gifts completely rather than retain use of them during life.

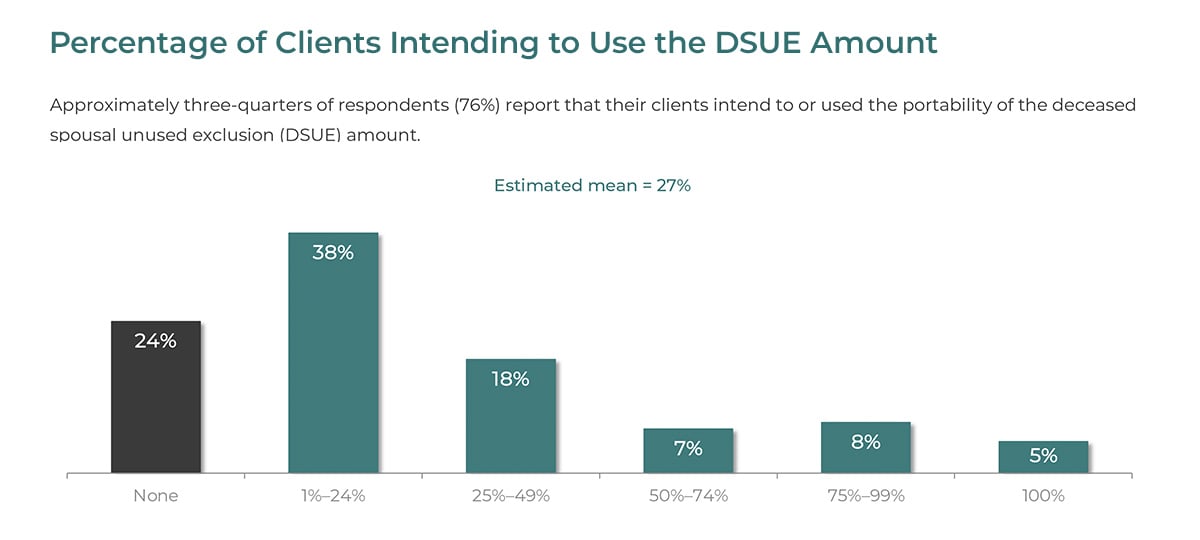

Make Use of the DSUE Amount

Another common client goal is to use the portability of the DSUE amount. Of survey respondents, 76 percent have clients who have taken advantage of this portability. It allows the client to apply the unused portion of a deceased spouse’s exemption amount for the surviving spouse. This option began on January 1, 2011. It does not apply to the generation-skipping transfer tax. To take advantage of it, the estate must file a tax return within fifteen months of the deceased spouse’s death (assuming a six-month automatic extension is requested). For a deceased spouse’s estate in which an estate tax return is not otherwise required, portability may be requested up to two years after a decedent’s date of death. A client will exhaust the DSUE before using their own exemption amount.

Help Clients Achieve Their Estate Planning Goals

The 2022 Estate Planning Survey revealed much more information, including concerns around cryptocurrency and nonfungible tokens, trust drafting trends, and common referral sources. To download the full report, click the link below.

.jpg)