Recession indicators, such as the recent inversion of the yield curve (which has accurately predicted all U.S. recessions in the last 60 years) are pointing towards a possible recession. With the topic garnering so much public attention, these fears of an impending national recession could become a self-fulfilling prophecy—particularly if enough people believe it’s going to happen and subsequently pull back their investments and slow their spending.

As such, now is a great time to reach out to your business clients and help quell their recession-doom-and-gloom fears by planning ahead. One way to do that is to ensure the business’ succession planning includes a buy-sell agreement with a bankruptcy provision.

When no buy-sell agreement exists, and a business is co-owned by multiple people, if one of the owners or investors files for bankruptcy, then a bankruptcy trustee could seize that investor’s interest in the business (i.e., stock) to pay off their bankruptcy debt—potentially resulting in disruption to the business’ operations while it’s tied up in bankruptcy court, sale to an unintended owner, or the liquidation of the business.

One way to protect your client’s business from this possibility is to ensure there is a bankruptcy provision in the business’ buy-sell agreement. This provision would be triggered when any co-owner faces bankruptcy and would require them to notify the other owners and the company before filing. In that event, the other owners can decide whether to buy the bankrupt owner’s share in the business at fair market value (keeping the business intact and out of bankruptcy court). Alternatively, the buy-sell agreement may allow the company to redeem or buy-back the bankrupt owner’s shares. Some buy-sell agreements even permit a bankrupt owner to sell his interest in the company to a third party, often with the approval of a majority or all of the remaining owners.

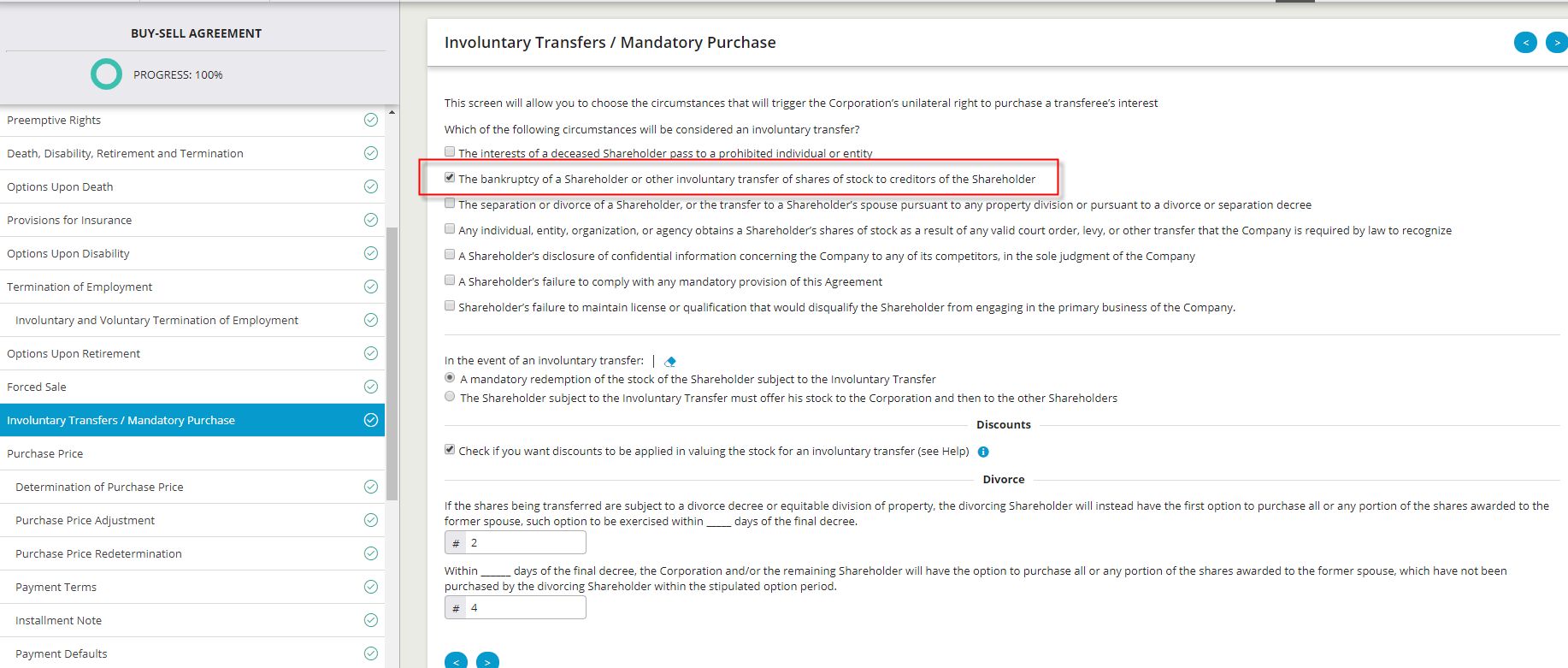

Specific language regarding this provision must be precise to be effective. Business Docx®—WealthCounsel’s business law drafting software, allows for the inclusion and easy customization of this provision within its buy-sell agreement template (see below).

Along with adding bankruptcy triggers, attorneys can add other triggering events within the provision, such as death, divorce or specific actions taken by a shareholder that may jeopardize the business’ operations or value. When any such trigger occurs, the agreement specifies the company’s and the co-owners’ rights relating to the triggering owner’s business interest.

Business Docx is the legal drafting software to help with all of your business planning needs—from formation and start-up to general operations and mergers, acquisitions, and buy-outs, Business Docx can help you efficiently create all of your business planning documents. Learn more about Business Docx here.

To conclude, a looming recession doesn’t have to signal a financial or business crisis, especially when business clients enter a recession prepared. As trusted advisors, business lawyers have an opportunity to promote the value of their services and help their clients anticipate and plan for potential events that could impact their businesses.

.png)