A Review of Estate Planning Techniques for High and Low Rate Environments

Written by Emily A. Plocki, JD, LL.M and Anna Katherine Moody, JD, LL.M

We are in a time when economic factors such as volatile financial markets and fluctuating interest rates combine to impact the effectiveness of a variety of estate planning techniques. From 2009 through 2021, interest rates sank to and remained at historic lows. However, due to various economic pressures, rates are on the rise, and it is important for clients and advisors to consider the estate planning opportunities that are most effective in the changing interest rate environment. Certain planning strategies and structures work best when interest rates are high compared to those that are implemented in low interest rate environments. While the current uncertain environment may—understandably—cause clients to hesitate to engage in a significant gifting regime, clients should review their balance sheets with their attorneys and financial advisors and discuss whether any of the planning structures described below provide an attractive planning opportunity for the client’s particular circumstances.

The primary goal of this article is to provide a high-level discussion of the estate planning techniques that present the greatest potential for upside when implemented during high interest rate environments juxtaposed to the techniques that succeed during times with low interest rates. Understanding which strategies are appropriate in the different or fluctuating environment will allow for greater utilization of your client’s remaining federal estate and gift tax exemption amount.

As a general reminder, in 2022, an individual has a combined federal estate and gift tax exemption of $12,060,000, and married couples have a combined exemption of $24,120,000. Subject to annual inflation adjustments, this exemption will remain in place through 2025, after which time it will be reduced to approximately one-half of its value.

The Applicable Federal Rate (AFR) and the Section 7520 Rate

Each month, the Internal Revenue Service (IRS) publishes certain market-based interest rates. These rates include the applicable federal rates (AFRs) and the Section 7520 rate.

For many estate planning techniques, the AFR for any given month is the lowest amount of interest that may be charged between related parties in a loan transaction without triggering imputed income or a gift. A different AFR applies depending on the term of the loan, with the short-term AFR applying to loan terms shorter than three years, the mid-term AFR applying to loan terms three years or longer but less than nine years, and the long-term AFR applying to loan terms that are nine years or longer.

The Section 7520 rate is the rate used to calculate annuity payments and the value of life estates and remainder interests for certain estate planning techniques, such as grantor retained annuity trusts (GRATs), charitable lead trusts (CLTs), and charitable remainder trusts (CRTs), each of which is discussed below.

On October 17, 2022, the IRS released the AFRs and the Section 7520 rate for November 2022 (Rev. Rul. 2022-20), with the Section 7520 rate being 4.8 percent, and the long-term, mid-term, and short-term AFRs set at 3.92 percent, 3.97 percent, and 4.1 percent, respectively.

The current rates are neither historically low nor high. By comparison, rates experienced in 2020 represented exceptional opportunities for planning using low interest rates, when the Section 7520 rate was 0.4 percent in November 2020, and the long-term, mid-term, and short-term AFRs were 1.17 percent, 0.39 percent, and 0.14 percent, respectively. On the other end of the spectrum, rates in the early 1990s created planning opportunities for high interest rates. For instance, in June 1990, the Section 7520 rate was 11.0 percent, and the long-term, mid-term, and short-term AFRs were 9.09 percent, 9.10 percent, and 8.82 percent, respectively.

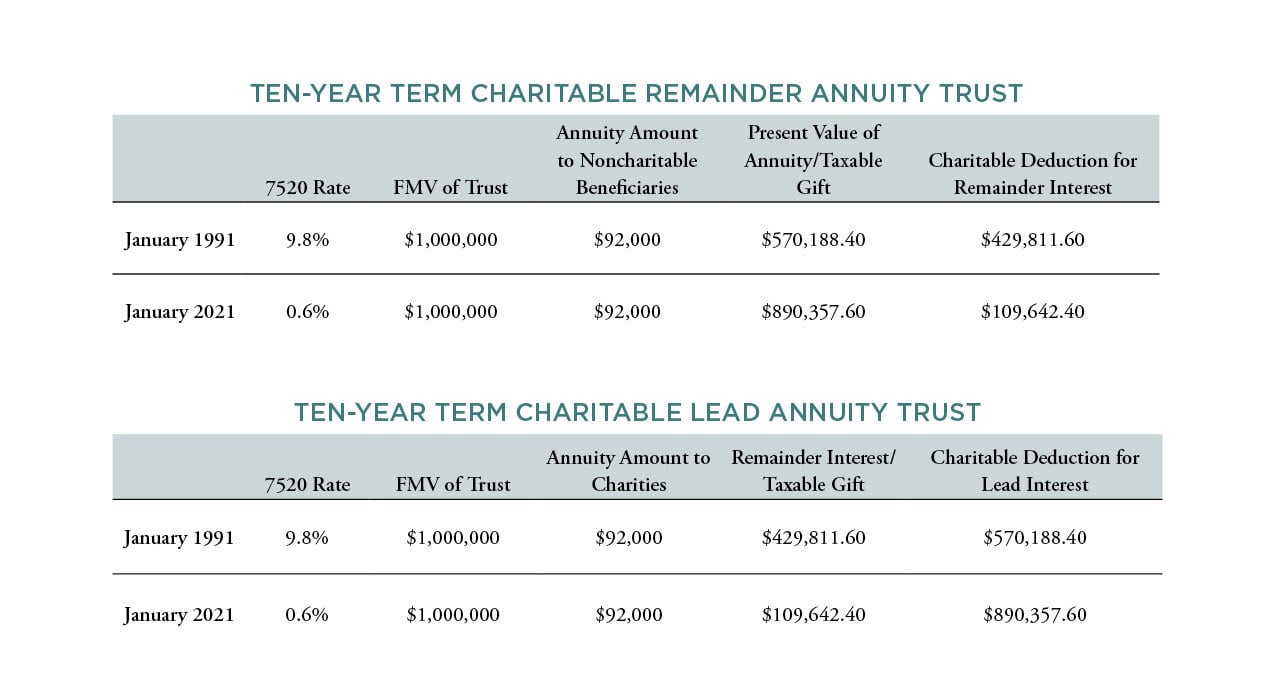

To illustrate the power of selecting a suitable planning vehicle based on the interest rate environment, let us compare the funding of a ten-year-term charitable remainder annuity trust (CRAT) with $1 million in January 2021, when the Section 7520 rate was 0.6 percent, with the same trust funded in January 1991, when the Section 7520 rate was 9.8 percent. If the annuity payment was $92,000 each year, the 2021 CRAT would have generated a taxable gift upon funding of $890,357.60 (reflective of the value of the annuity interest payable to the noncharitable beneficiaries determined by the January 2021 Section 7520 rate). The 1991 CRAT funded during the high interest rate environment would generate a $570,188.40 taxable gift upon funding. With all other aspects of the respective CRATs being equal at the time of funding, the higher Section 7520 rate generates a savings of $320,169.20 per $1 million of funding. Using the converse structure, if instead the $1 million funded a ten-year term charitable lead annuity trust (CLAT) with a $92,000 annuity payment, the January 2021 CLAT would generate a taxable gift of $109,642.40 (representing the remainder interest passing to the noncharitable beneficiaries) and the January 1991 CLAT would generate a taxable gift of $429,811.60.

A thorough explanation of CRT and CLT mechanics is discussed below, but the key point is that selecting the appropriate planning vehicle to complement the interest rate environment can yield very powerful results.

Overview of Low Interest Rate Planning Vehicles

1. Grantor Retained Annuity Trust

How it works. A GRAT is an irrevocable trust to which the creator of the GRAT (the grantor) transfers assets and retains the right to receive fixed annuity payments from the trust for a specified number of years. After the GRAT makes the required annuity payments for the predetermined term of years, any property remaining in the GRAT passes to the designated beneficiaries (or to trusts for their benefit) free of federal estate and gift tax.

Tax and nontax considerations. A GRAT can be a highly effective wealth transfer option in a low interest rate environment due to the greater potential for the GRAT’s assets to outperform the Section 7520 rate (also commonly known as the hurdle rate) in effect in the month the trust was created. Thus, to the extent the assets transferred to the GRAT (e.g., marketable securities or interests in commercial real estate or a closely-held business) reflect current depressed values and would generate an investment return in excess of the current GRAT hurdle rate (4.8 percent in November 2022), the larger the potential tax-free gift to the remainder beneficiaries.

The creation of a GRAT produces a taxable gift by the grantor to the remainder beneficiaries that is equal to the excess of the initial value of the contributed assets over the present value of the annuity payments to the grantor, discounted by the Section 7520 rate. The duration of the GRAT and the percentage annuity retained by the grantor can be structured so that the present value of the annuity payments retained by the grantor equals the value of the contributed assets to the GRAT, with the result that the remainder interest has a value of zero. The grantor of a zeroed-out GRAT makes no taxable gift and uses no gift tax exemption. So, if the GRAT assets do not appreciate beyond the Section 7520 hurdle rate, the grantor has not used any gift tax exemption, and the transaction is a wash. In some circumstances, it is preferable to design a GRAT so that the present value of the remainder interest of the GRAT at creation is small (but not equal to zero) for the grantor to report the GRAT contribution on a federal gift tax return (Form 709). If properly reported, the statute of limitations1 will begin running and, thus, limit the time period that the IRS has to audit the GRAT transaction.

Another advantage of a GRAT is that during the annuity period, it is considered a grantor trust as to the grantor. This means that the grantor is considered the owner of the GRAT for income tax purposes and is taxed on all of the income. Payment of the income and capital gains taxes by the grantor is, in effect, a further tax-free gift to the remainder beneficiaries, since the assets can continue to grow during the annuity term without reduction for such income and capital gains tax payments.

The duration of the GRAT annuity period retained by the grantor is a very important consideration. If the grantor survives the annuity term, the property remaining in the GRAT will pass to the remainder beneficiaries, outright or in further trust, without the imposition of gift or estate tax (although there may be generation-skipping transfer tax consequences depending on the relation of the remainder beneficiaries to the grantor at the time of the distribution). However, if the grantor dies prior to the expiration of the annuity term, a portion or all of the GRAT assets will be included in the grantor’s estate for estate tax purposes. Therefore, the longer the annuity term, the greater the risk that the grantor may die during that period, resulting in estate tax liability.

Generally, there are two philosophies to consider when determining the appropriate annuity term for the GRAT. First, to tighten the exposure during volatile markets and limit the mortality risk of the grantor passing away during the GRAT term, it may be appropriate to use a shorter-term duration for the GRAT, such as two or three years. Alternatively, and particularly in low interest rate environments, longer-term GRATs, such as seven-year or ten-year GRATs, may be preferable because clients can lock in the low interest rates. Second, where GRATs perform better than anticipated during the initial years of the GRAT term, the grantor may choose to lock in the significant asset appreciation by purchasing the appreciated assets from the GRAT to hedge against losing those gains in later years. Another estate planning tool is to engage in rolling GRATs. Under this method, when the grantor receives an annuity payment from one GRAT, the grantor immediately uses that payment to fund a new GRAT.

Generally, the investment return on the assets contributed to a GRAT in the early years greatly impacts the GRAT’s overall performance; therefore, it is important for clients to consult with their advisors regarding (1) whether there are assets that are suitable for use in a GRAT, (2) the right duration for the annuity period of a GRAT, and (3) the best investment strategies for the assets that are held in the GRAT. GRATs require valuation of the trust property each year, so marketable securities are well-suited to use in a GRAT transaction . . .

Read the full article and learn about other low and high interest planning vehicles by subscribing to the WealthCounsel Quarterly—the free legal magazine for estate planners and business lawyers.

1. In general, if Form 709 is submitted and it adequately discloses the gift, I.R.C. § 6501(a) provides that the Internal Revenue Service must assess a gift tax within three years of the filing of the Form 709.

.jpg?width=1656&height=818&name=Interest%20Rate%20Rollercoaster%20(1).jpg)

.png)