While there are many ways to change the terms of an irrevocable trust, decanting proves to be one of the most effective methods. An irrevocable trust does not necessarily mean that it is unchangeable, as the terms can be altered after it is poured (decanted like a bottle of wine) into a new trust. Trust decanting is a useful tool for estate planning attorneys who are striving to make a trust better fit the needs of the client. The authority to decant a trust can be included in the original trust, or it can stem from the decanting statutes in more than thirty states.

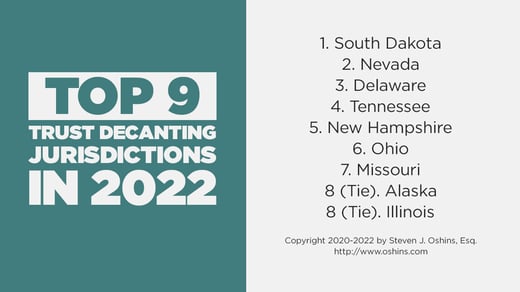

The top-ranked states below have laws that are very friendly to trust decanting, so establishing a trust in one of these states can be advantageous. Read on to learn more about the best states for trust decanting.

Reasons to Decant a Trust

Life is unpredictable, so decanting a trust can offer flexibility to continue to achieve the purposes of a trust amid life’s changes. Here are some specific reasons to decant a trust:

- Modify powers of appointment

- Change trustee provisions and investment powers

- Create a special needs trust

- Combine or separate trusts for greater efficiency

- Change from a grantor trust to a nongrantor trust

- Expand the terms of a trust

- Change from an ascertainable standards trust to a discretionary trust

- Move income tax liability to low-income taxpayers

- Manage state income tax

- Correct drafting errors or ambiguous terms

- Qualify a trust to own S corporation stock

- Change the situs or governing law of the trust

- Address unanticipated issues such as physical or mental disability

- Add a spendthrift clause or modify distributions to safeguard funds from creditors

- Change a trust’s tax attributes

- Get a step up in income tax basis

Basic Concepts of Trust Decanting

To decant a trust, the trustee must have discretionary distribution authority in the original trust. This is true even if the trustee is a beneficiary of the trust. It may also be a requirement that the beneficiaries receive notice before a trust can be decanted. New terms of the decanted trust can include the following:

- A change in trust beneficiaries

- Power of appointment granted to a beneficiary

- Beneficiaries’ trust interests accelerated

- The distribution standard altered

- The trustee fee increased

- Tax savings provisions granted

Top States for Trust Decanting

When considering the state in which to establish a trust, you should know about the advantages of states with specific trust decanting statutes. In 1992, New York was the first state to enact a trust decanting statute, but other states have come up with even better provisions since then, some of which include the following:

- Mandatory income interest can be removed

- Power of appointment to a nonbeneficiary can be made in the second trust

- Remainder of a beneficiary interest can be accelerated

- A trust with an ascertainable standard (such as for health, education, support, and maintenance) can be changed to a discretionary trust

- No notice required to beneficiaries

The top states are based on the rankings of expert attorney Steven J. Oshins as of 2021.

1. South Dakota

South Dakota is the top-ranked state for trust decanting, as its statute allows for the most flexibility in trust decanting provisions. In addition, South Dakota ranks first in the United States for states in which to create a dynasty trust and second for states in which to create a domestic asset protection trust (DAPTs).

2. Nevada

The Silver State is almost tied for first place with South Dakota as the top-ranked state for trust decanting. It has all of the trust decanting advantages of the Mount Rushmore State; the only difference is that Nevada is ranked number one for states in which to establish a DAPT and number two for states in which to establish a dynasty trust.

3. Delaware

The First State ranks slightly lower than the two leaders because it does not allow decanting from a trust with an ascertainable standard to a discretionary trust. In addition, Delaware is tied for seventh place for the best states in which to create a dynasty trust and sixth place in which to create a DAPT.

4. Tennessee

Unlike Delaware, Tennessee allows decanting from a trust with an ascertainable standard to a discretionary trust. However, it does not allow the removal of mandatory income interest. Also, its statute is silent on the acceleration of remainder beneficiary interests. The Volunteer State ranks third for states in which to create dynasty trusts and is tied for sixth for states in which to create DAPTs.

Ideal Situations for Trust Decanting

Your client does not have to be a South Dakota or Nevada resident to take advantage of their favorable trust decanting statutes. In a recent webinar, Oshins shared that several of his clients travel from California to his office in Nevada to take advantage of its trust decanting statute, because California ranks in the middle regarding favorable provisions among states with trust decanting statutes.

Decanting a trust, whether in the client’s home state or in a different state, can produce several benefits. A trustee can use a power of appointment to direct the assets toward family members who need them. The trustee can also include assets in the estate so they receive a step up in basis at the time of the trustee’s death. This could save thousands of dollars for the surviving family members.

Learn from the Premier Expert on Trust Decanting

Learn more about this topic by watching Steven J. Oshins Esq., AEP (Distinguished), the creator of the State Rankings Charts, speak about enhanced tax savings, asset protection, and divorce protection in our on-demand webinar. The webinar is CLE eligible. Click here to purchase.