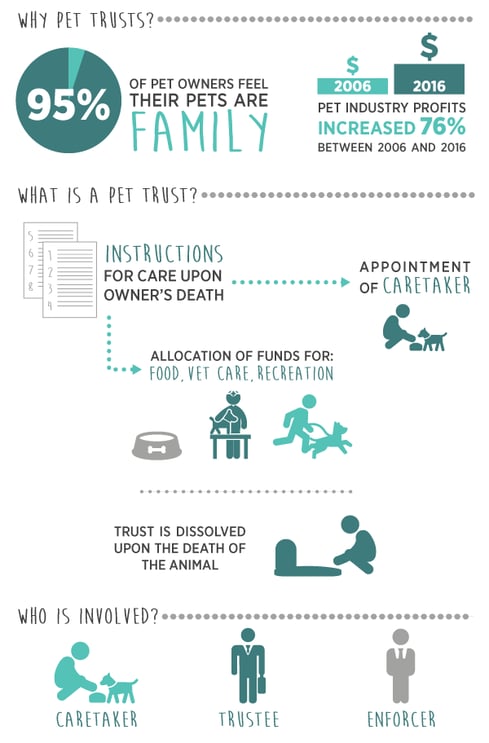

Whether as a friendly companion or a fully-fledged family member, pets have become an intrinsic component to many households. According to the American Pet Products Association, 67% of American families own a pet today. Not only is pet ownership up from 56% in 1988, but Americans are also spending significantly more on their pets. In 2016, the pet industry raked in roughly $66 billion in pet-loving profits, a 74% increase from 2006. An explanation for this spending increase could be because most pet owners﹘about 95%﹘consider their pets to be part of the family.

It’s a wonder then, why the estate planning field often overlooks pets. While pet trusts can claim a small fraction of the pet industry profits, only about 12% of cat and dog owners make financial stipulations for their pets in their estate plans. This underutilized market has significant business potential for estate planning attorneys and provides an opportunity to serve clients better.

Pet Trusts: What are they and how to introduce them to your clients

Planning for animal care is similar to planning for dependent children. As such, trusts are seen to be superior to wills as they can bypass the lengthy probate process, which can significantly delay financial support for the animal. In addition, a will cannot protect and care for a pet in the event of their owner’s incapacity.

Breaking it down: how a pet trust works

At its most basic, a pet trust lays out instructions on how a pet should be cared for after its owner passes away. A caretaker is usually chosen to be responsible for the pet’s day-to-day care. Funds are allocated to the trust to pay for various expenses such as food, veterinary care, and recreation.

A trustee is chosen to manage the trust’s funds and oversees the caretaker’s compensation for caring for the animal. As another level of protection, a client can also choose to appoint an enforcer, who oversees the trustee. Once the animal passes away, the remaining funds can then redistribute to the living beneficiaries or a charity of the client’s choosing.

Educating clients on pet trusts

As many people are unaware of the benefits of a pet trust, an attorney’s primary goal is first awareness and then education. Attorneys can utilize email campaigns to educate current clients on the importance of pet trusts, providing awareness and a call to action to add animal care provisions to their existing trusts.

For prospective clients, attorneys may want to consider adding pet ownership questions to their new client intake forms. Statistically, more than half of your clients will indicate “yes,” which will give you the opportunity to educate them about this service.

Important factors to consider when drafting a client’s pet trust

Pet trusts may be suitable for couples who don’t share the same affinity or level of care for the pet. For clients who have brought previously owned pets into their marriage, or if one spouse simply doesn’t share the same affinity for a pet, a pet trust might be in order. In the event that one spouse passes away and is concerned their surviving spouse may be unable or unwilling to care for the animal adequately, a pet trust can ensure the deceased owner’s wishes. This option also provides financial and logistical relief for the living spouse, as they will not have to worry about their spouse’s pet after they are gone.

Animals with special medical needs, longer lifespans or defined as “exotic” may need more money allocated for their care.

There are a few different factors to consider when determining the number of funds to allocate for a pet’s care. Species, length of lifespan and whether or not the animal has, or may need, special medical care, are usually the biggest defining factors. For example, animals such as macaws, parrots, and snakes may require more significant funds due to longer lifespans, than say dogs or cats. Also, certain types of dog breeds like American bulldogs and German shepherds may need more funding due to their predisposition to health issues like hip dysplasia and respiratory problems.

Caretaker suitability should depend on lifestyle and personal regard for the animal.

It’s essential that a pet owner choose a caretaker for their animal wisely, to minimize disruption of care. Make sure to help your client by clarifying that their choice for caretaker has adequate housing, time and experience to look after the animal. To avoid trouble down the road, ask the client if they think the caretaker would want the job, or better yet if they have already discussed this responsibility with them.

Be aware of your state’s funding limitations.

Some states have imposed funding limitations on pet trusts. Should the funding limit be exceeded, a court may reduce and redirect the trust’s property according to law. Thus, it is important to be aware of state-specific rules, so that your client’s wishes are fully realized.

WealthCounsel’s superior estate planning document drafting software, Wealth Docx®, now includes pet trust provisions. Effortlessly customize each document by creating and saving pet trust clauses that easily add into any future document. Eliminate inefficient duplicate data entry by creating client profiles – names, addresses, and other client specific information can then be auto-populated throughout your trust document.

Visit our website to learn more, or schedule a software demo with a member of our knowledgeable sales team.